Financial Adviser Insights, Dec 14, 2023

Adviser Numbers This Week, Net Change of Zero Remaining At 15,670

Click Here To Access Basic / Free Adviser Dashboard

Need More Data?

Special Offer As We Launch Our Financial Adviser Client Segmentation Tool

Use Promo Code: 50%MONTH1

A 50% Discount On Your First Month’s Subscription (No Monthly Limits)

Join our Members Lounge - Click Here For Membership Information -

Enter promo code 50%MONTH1 for 50% discount on first month Selecting 'YEARLY' cost is only $950

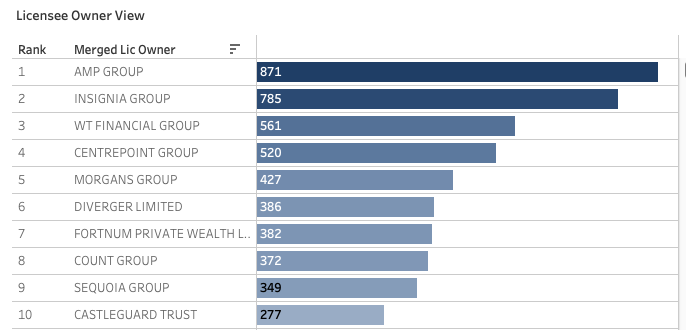

AMP Group are once again the largest business as measured by the number of financial advisers. AMP leapfrogged Insignia after WT Financial Group secured the Millennium 3 AFSL from Insignia*. More below. Note that when a sale or merger takes place, we do not show the deal directly in the weekly updates.

Key Adviser Movements This Week:

Net change of advisers at Zero

Current number of advisers at 15,670

Net Change of (-128) for Calendar YTD

Net Change Financial YTD +114

24 Licensee Owners had net gains of 32 advisers

22 Licensee Owners had net losses for (-33) advisers

2 New licensees and 1 ceased Note: If you would like to access a list of closed licensees, please contact us.

5 New entrants.

Number of advisers active this week, appointed / resigned: 73

Growth This Week - Licensee Owners

Shaw and Partners picked up another 5 advisers, 3 from Morgan Stanley and 1 each from Macquarie and Ord Minnett

A new licensee commenced with 3 advisers

Count Group up by net 2, with both advisers from Consultum owned by Insignia

Alexander McWilliams (True Wealth Financial Group), with 2 advisers coming back after a break

A tail of 20 licensee owners up by net 1 each including Spark Partnership Group, Findex, Centrepoint and the remaining new licensee

Losses This Week - Licensee Owners

Australian Investment and Insurance Group down (-4) advisers. They have now lost 7 in the last few weeks

Insignia also down (-4), with 2 joining Count and the other 2 yet to be reappointed

Euroz Hartleys Group down by (-3), none showing as being appointed elsewhere to date

Clime Group, LFG and a small licensee Four Points Financial owned by David Meek all down by (-2)

16 licensee owners down by (-1) each including Diverger, Minchin Moore and Fiducian

Largest Licensee Owners

This week, we have included Millennium 3 (M3) as being owned by WT Financial Group. The ASIC Financial Adviser Register (FAR) is still showing Insignia as the M3 owner. However, a formal announcement was made at the ASX that the deal completed this week. Licensees have 30 days to update the ASIC FAR.

As a result of the deal, AMP Group leapfrogged insignia to be the largest business, as measured by the number of financial advisers. WT Financial Group move up one spot to third position.

Both AMP and Insignia have lost a significant number of advisers over recent times. To put this into context, when Insignia (then IOOF) announced that they entered into an agreement with MLC on August 31, 2020, they indicated in their ASX announcement, that they would be the #1 advice business by number of advisers at 1,884.

Top 10 Advice Firms by Number Of Advisers - Dashboard 2 of Adviser Fast Facts

*When a deal with licensees completes, we merge the licensees into the new licensee owner and by default, the new owner also gets the history of movement associated with the licensee.

Financial Adviser Client Segmentation Tool - Update

We recently launched our Financial Adviser Client Segmentation Tool that assists financial advisers to focus on a client base that will work in the current climate. With today’s announcement from Stephen Jones, Minister For Financial Services, of ‘free advice’ from ‘qualified advisers’, this will ultimately put pressure on current advice firms to fully understand which client segment they should focus on.

The client segmentation tool allows advisers to make data driven decisions to better understand the revenue by segments, impact on their time and breaks revenue to the hour.

We have written a short blog post and updated our demo video. Access is only $42.50 for the client segmentation tool and a lot more. You can join today with 50% discount off the first month by using the promo code 50%MONTH1

Have a great week and checkout the

Members Lounge for all of your data needs - Click on box below

Special Offer Use Promo Code: 50%MONTH1

A 50% Discount On Your First Month’s Subscription (No Monthly Limits)